Federal Agents Warn of an Alarming New Trend--Fraudsters Recruiting Unsuspecting Romance Scam Victims to Assist in Money Laundering Crimes

Do these unwitting victims deserve felony convictions and prison for their role in these schemes? Or is it time to consider a national pretrial diversion program for these victims-turned-accomplices?

CBS News ran a story last week reporting how romance scam victims are not only being drained of their life savings, but also being recruited by fraudsters to unwittingly join in their criminal schemes.

The investigative report noted that through a combination of manipulation, shame and embarrassment, “pig butchering” romance scammers are turning their victims into accomplices and encouraging them to engage in money laundering crimes. Sadly, some of these unsuspecting victims are even being prosecuted for their role in furtherance of these schemes.

CBS New reported about the tragic case of an Illinois woman who fell victim to a romance scam, lost $1.5 million of her money and was then later found dead. After the woman went missing, her daughter learned that her mother was not only a victim, but that she was also deeply involved in the scam herself. The widow fell prey to a romance scammer in Ghana who fleeced her out of her money with promises of love and a life together. After the scammers took her money, they then persuaded the woman to set up bank accounts and fake profiles to help lauder other victim funds.

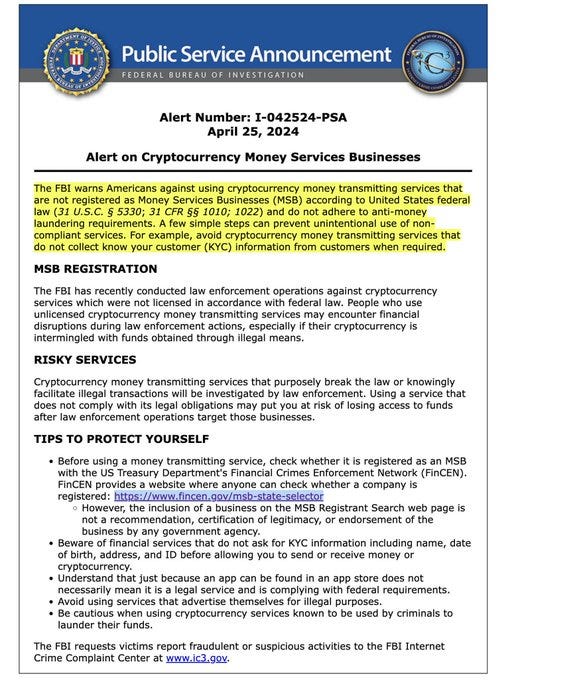

Initially, these victims are typically unaware that what they are doing is even a crim. But under federal law, acting as a "money mule" is a federal offense. Money mules can face prosecution for a range of federal crimes including operation of an unlicensed money trasmitting business, wire fraud and even money laudering. FBI Issues Alert on Crypto and Unlicensed Money Transmitter Business

But money mules don’t always start out as criminals. They are instead gradually drawn into these schemes by very savvy fraudsters who know how to pull at their heart strings. They are often brainwashed by scammers and mentally and emotionally coerced into engaging in these criminal activities.

The CBS report highlights the complex emotional and legal challenges in addressing these scams. And while law enforcement agencies often struggles with how to treat cases involving these victims-turned-accomplices, some of these life-long law abiding individuals are being prosecuted and their lives destroyed for their role in these crimes.

Despite my pleas for leniency, prosecutors continue to treat these unwitting victims as criminals and prosecute them. These individuals not only suffer the shame and humility of being fleeced of their life savings, but they also face the prospect of prison time and a felony convictions for their conduct. This trend is particularly concerning given the fact that law enforcement agencies have launched a national campaign to try and warn romance scam victims of these very real dangers.

For well over a year now, I have been speaking nationally about this new and frankly alarming pattern in connection with romance scams. Last year I discussed this growing trend at the New York State Bar Association’s CLE conference on cryptocurrency law.

Last month, I again raised these same concerns while speaking on a panel at Indian University discussing legal trends in blockchain technology and digital currencies.

What is “Pig Butchering”

"Pig butchering" is an internet fraud scheme that primarily targets individuals looking for romantic relationships online. The term is derived from the practice of raising a pig and feeding it until it is ready for slaughter. Similarly, in this scam, the fraudster (also known as the "pig butcher") gains the trust of their victim (the "pig") over a period of time before eventually defrauding them of their money or personal information.

Often times, the victims of these scams are older woman who are lonely and looking for companionship. Overseas transnational criminal organizations target these woman through fake accounts and stolen profile pictures of handsome and “available” bachelors who lavish these woman with promises of real and lasting relationship.

So what do many of these unsuspecting victims share in common? Transnational criminal organizations often target older individuals who are lonely, have disposable income and very little understanding at all about cryptocurrencies. Victims are emotionally manipulated into investing money, which the scammers then claim is locked up, urging further investments to recover losses or gain profits.

Once the scammers extract as much money as they can from these romance scam victims, they often then recruit these victims to act as money mules, unwittingly laundering money through their accounts under the guise of helping their romantic interests. The emotional manipulation and trust built during these scams lead victims to ultimately check their common sense at the door and comply without recognizing the true criminal nature of their actions.

Overcome with embarrassment and shame, many choose not to report their experiences to family or law enforcement, fearing judgment and the stigma associated with being duped. This silence allows the fraudsters to continue their schemes unchallenged and pull these unsuspecting victims further and further into a dark web of fraud and deceit. Thereby turning these victims into unwitting accomplishes.

Until more can be done to educate the public of these dangers, I will continue to advocate for prosecutors to treat these victims-turned-accomplices with compasion as opposed to prosecution. One solution I have been advocating for is a Money Mule Pretrial Diversion Program that avoids these individuals ending up with criminal records.

According to the DOJ:

Pretrial diversion (PTD) programs divert certain offenders from traditional criminal justice processing into alternative systems of supervision and services. PTD programs provide prosecutors with another tool – in addition to the traditional criminal justice process – to ensure accountability for criminal conduct, protect the public by reducing rates of recidivism, conserve prosecutive and judicial resources, and provide opportunities for treatment, rehabilitation, and community correction. https://www.justice.gov/jm/jm-9-22000-pretrial-diversion-program

Through pretrial diversion, prosecutors can give these unsuspecting accomplices a second chance. The program offers a probation-like term of supervision assuring these individuals do not violate the law again. These programs can even offer an opportunity for these unsuspecting accomplices to pay restitution for the harms they’ve caused in exchange for acceptance into a pretrial diversion program. In the end, this is the best solution for this unique class of criminal targets.